The availability of data centers is at the foundation of most applications we use on a daily basis. Failure in the data center can result in payment transaction delays and security issues. As a logical step towards safety, partnering with a resilient and adaptable data center for financial services is of critical importance for financial institutions.

The financial services industry has seen significant transformations. It has evolved to meet new expectations by making fast and secure transactions possible while complying with regulations to secure essential data. The broadening of digitalization has brought commodities and conveniences for users, all facilitated by financial services.

The world keeps evolving digitally, but so do cyber threats, targeting network vulnerabilities and putting financial data at risk. Data centers for financial services play an important role in ensuring data safety and cybersecurity, emerging as indispensable partners for digitalized financial services.

In this article, we will look into how forming a partnership with a cutting-edge data center for financial services is imperative for secure and efficient financial operations. Let’s dive into it.

Data center infrastructure: supporting pillars of the financial industry

The financial services sector is dealing with large volumes of sensitive data. This type of data – like personal information – requires increased protection. Consequently, a resilient and adaptable data center for financial services is the best deal for organizations handling sensitive transactions. Data centers are critical pillars in ensuring data protection and all the required security measures, both on the physical and the network level.

Physical security

Data centers for financial services have to have security in mind right from the level of planning. Starting with the location, data centers are built on sites that are safer from a geographical point of view. Many of them are designed to withstand eventual natural disasters.

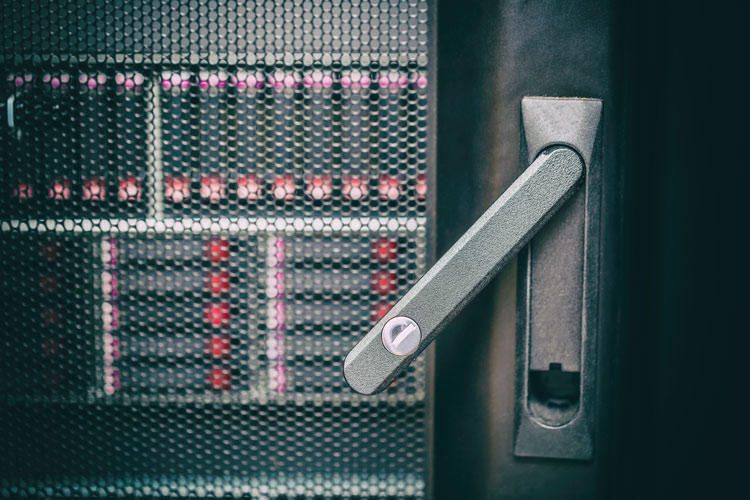

Data centers incorporate different security measures on-site at the level of the building itself. Fences, access control systems, surveillance cameras, locks, and sensors are deployed to protect the data center from unauthorized access, theft, vandalism, or corruption.

A data center for financial services, but all data centers must incorporate interior security measures as well. Those measures include well-trained security personnel, access control systems, security checkpoints, cameras, physical barriers, and alarms. To avoid the risk of catastrophes, data centers are equipped with fire alarm systems and monitoring devices.

Additionally, the server racks themselves have physical security measures incorporated. Those are climate control sensors, logging and tracking mechanisms, seals and locks, and redundant power and backup.

Cybersecurity precautions in a data center for financial services

To prevent the distressing consequences of downtime and to protect sensitive data generated in the financial sector, a data center for financial services has to take specific measures. This means implementing redundancy wherever possible to reduce the risk of data loss and disruptions leading to client dissatisfaction and profit loss.

Breaches are a significant threat to financial institutions. Cyber threat trends show that cybercriminals are constantly trying to access sensitive information, using a variety of tricks and tactics that are getting more sophisticated every day. Unfortunately, the arrival of AI has brought benefits for cybercriminals, who take advantage of this tool to create misinformation, deepfakes, and other attacks.

However, trained AI can recognize security issues and take preventive measures. Artificial intelligence is a valuable tool for the financial sector for getting insights, improving customer experience, intelligent automation of processes, and, of course, fraud detection solutions. Considering the high level of risk, partnering with a resilient and adaptable data center for financial services is of absolute importance.

Cybersecurity planning

Knowing the devastating outcomes of becoming a victim of a cyber attack, a data center for financial services has elevated responsibility in ensuring safety on multiple layers. Protection is a matter of preparedness in the financial sector, where the safety of data is non-negligible. Shielding the attacks is an ongoing challenge for the data center. DDoS mitigation strategies, firewalls, and intrusion detection systems are must-haves, alongside the additional updates, monitoring, and evaluation, to ensure that everything is up-to-date and running as efficiently as possible.

Typically, a data center for financial services operates with encryption techniques that ensure data protection in the transit state. Encryption converts data into code, with the purpose of making it unreadable in case it gets into unauthorized hands.

With the emergence of AI, automating specific tasks is becoming increasingly available, and data centers are adopting the technology at a fast pace. Still, online security planning needs a more comprehensive approach than merely transferring all tasks to machines. Combining human expertise and supervision with automation is the best and safest approach at present to cybersecurity planning for the financial sector.

The price of being caught unprepared

Let’s start with the excruciating facts. The average cost of a data breach was 4.45 million In 2023. Moreover, some cases reached 10 million and above. The financial industry has hit rock bottom in the past with the 2008 crisis, and since then, the stakes of business continuity planning have been high, becoming one of the most fundamental preventive measures in the industry. The catastrophe has led to new, reinforced regulations and rules, including for financial institutions labeled too big to fail.

However, since then, the industry has become more intertwined with IT. The impact of a data breach is major when it comes to the financial sector. Having a robust and safe data center for financial services supporting organizations has become non-negotiable. With the rise of AI, data centers are constantly evolving and rethinking traditional approaches to meet the challenges of new threats and rule out potential vulnerabilities.

Disaster recovery and business continuity solutions

Even if an organization follows a security protocol, cyber attacks can happen. This is due to the fact that the threats are evolving, and no one can be 100% prepared for something that doesn’t exist yet. For this reason, partnering with a data center for financial services that can offer thorough business continuity and disaster recovery planning is paramount. Knowing the devastating effects of a data breach is important. But having a plan ready in case it happens can be just as critical.

Complying with industry standards

A well-prepared data center for financial services that can offer compliance with industry-specific regulations and standards can be critical for a financial organization. EFTA, SOX, FISMA, DSS, PCI, and the list goes on. The battle for the safety of sensitive information is one that’s here to stay. Nevertheless, it is essential for financial institutions to partner with the right data center for financial services. Breaches can happen, and it’s important that when they do, a capable and prepared data center is there to cushion the fall.

Offering compliance services and certifications is a type of guarantee. It demonstrates that the data center is capable of maintaining data integrity and confidentiality. Global certifications like the HITRUST are relevant and cherished in a data center, offering proof that the data center is highly prepared and meets industry requirements.

Colocation data centers for financial services

Managing the complexity of financial services is not a simple task. When having to comply with new regulations, on-premise data centers might not be sufficient. A colocation data center for financial services can offer a higher level of efficiency and cost-effectiveness. The winners are third-party data centers that can provide excellent risk management services, robust infrastructure, and the best connectivity. They don’t go unnoticed on the market. Providers that can offer security, scalability, and resilience will be the sought-after partners for financial services institutions.

Conclusion

Partnering with an apt data center for financial services that can offer elevated security, industry compliance, and state-of-the-art connectivity is crucial for financial services organizations. A financial services organization’s data is too sensitive to be played around with. Customer information, market research data, financial records, and more are at risk in case of a disaster. With the world becoming more and more interwoven with technology, the need for resilient data centers offering security and disaster recovery solutions will continue to stay paramount, having a ripple effect on many areas of our lives.

Got questions? Want to talk specifics? That’s what we’re here for.

Discover how Volico Data Centers can offer your organization the IT backbone to stay ahead of the competition in a booming market.

• Call: (305) 735-8098

• Chat with a member of our team to discuss which solution best fits your needs.